introduction Eurozone Growth

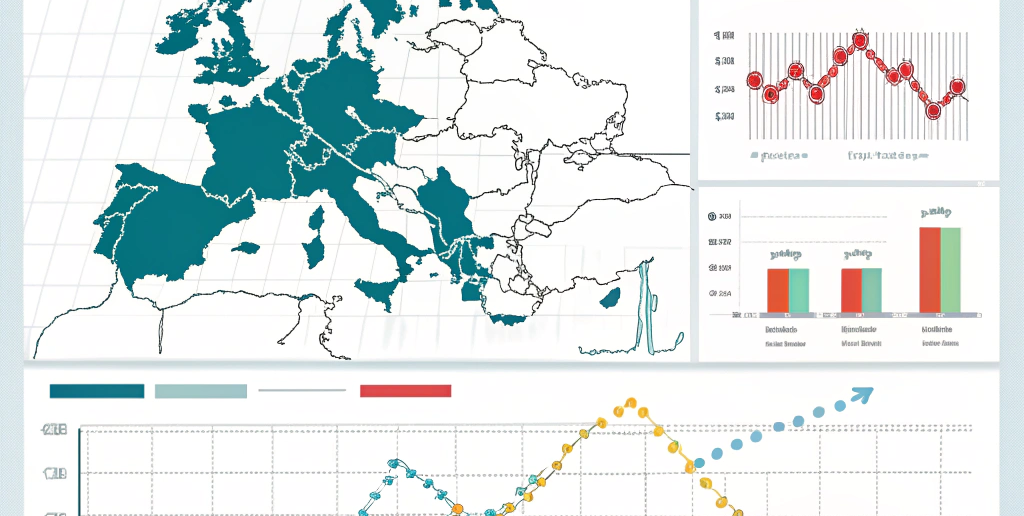

Why Eurozone Growth Is Slower Than the U.S. (Explained) Eurozone economic growth is usually slower than U.S. growth because the two systems prioritize different trade-offs. The U.S. tends to favor speed, flexibility, and risk-taking, while the eurozone emphasizes stability, regulation, and social protection. Slower growth isn’t automatically a failure—it’s often the result of deliberate choices.

This matters because eurozone growth is frequently described as “weak” or “lagging,” especially when compared to the U.S. That comparison can be misleading. Growth speed alone doesn’t capture resilience, income stability, inequality, or long-term sustainability. Understanding why the eurozone grows more slowly helps put economic headlines into context—and avoids false conclusions.

FAQs Eurozone Growth

Conclusion Eurozone Growth

- The Short Answer (Featured-Snippet Ready)

The eurozone grows more slowly than the U.S. because it prioritizes economic stability, worker protection, and regulation, while the U.S. favors flexibility, faster capital movement, and higher risk-taking.

- Different Economic Models, Different Outcomes

At a high level:

the U.S. economy is more market-driven,

the eurozone economy is more coordinated and regulated.

The U.S. model:

allows faster hiring and firing,

encourages venture capital risk,

tolerates higher inequality.

The eurozone model:

protects workers more strongly,

regulates markets more heavily,

emphasizes social safety nets.

These choices directly influence growth speed.

[Expert Warning]

Faster growth often comes with higher volatility and inequality.

- Labor Markets and Employment Protection

European labor markets tend to:

protect permanent workers,

limit sudden layoffs,

encourage long-term employment relationships.

This leads to:

lower job turnover,

more income stability,

slower adjustment during booms and busts.

In contrast, U.S. labor markets adjust rapidly—boosting growth during expansions but amplifying downturns.

- Innovation, Risk, and Capital Allocation

The U.S. ecosystem:

rewards aggressive innovation,

channels large capital into startups,

tolerates frequent failure.

The eurozone:

supports incremental innovation,

invests more conservatively,

prioritizes industrial continuity.

This doesn’t mean Europe lacks innovation—it means innovation is often slower, steadier, and less speculative.

[Pro-Tip]

High-growth innovation and long-term industrial strength are not the same thing.

- Demographics and Population Growth

Population trends matter.

The eurozone generally faces:

aging populations,

lower birth rates,

slower workforce growth.

The U.S. benefits from:

higher population growth,

immigration-driven labor expansion,

younger demographics.

Slower population growth naturally limits headline GDP growth—even if productivity is strong.

- Fiscal Policy and Public Investment

The eurozone places more emphasis on:

fiscal discipline,

debt sustainability,

long-term public services.

This limits short-term stimulus but:

reduces crisis vulnerability,

maintains investor confidence,

stabilizes public finances.

The U.S. uses fiscal stimulus more aggressively—boosting growth, but often increasing debt faster.

- Information Gain: Slower Growth as a Stability Choice

What many analyses miss is this:

Slower growth is not always a problem—it can be a policy outcome.

The eurozone trades:

speed for stability,

flexibility for protection,

volatility for predictability.

This choice produces fewer economic extremes—both positive and negative.

[Expert Warning]

Growth rate comparisons ignore social and structural outcomes.

- Practical Table: Eurozone vs U.S. Growth Drivers

| Factor | Eurozone | United States |

| Labor flexibility | Lower | Higher |

| Risk tolerance | Moderate | High |

| Population growth | Slower | Faster |

| Regulation | Stronger | Lighter |

| Growth volatility | Lower | Higher |

- Common Misconceptions

Misconception 1: Slower growth means failure

→ It often reflects different priorities

Misconception 2: Europe lacks innovation

→ Innovation is structured differently

Misconception 3: Faster growth is always better

→ It increases volatility

Misconception 4: Policies are inefficient by accident

→ Many are intentional trade-offs

- UNIQUE SECTION — Real-World Business Comparison

A U.S. startup:

scales quickly,

raises large funding rounds,

may fail fast or succeed big.

A European firm:

grows steadily,

focuses on profitability earlier,

survives longer with fewer extremes.

Both models create value—but on different timelines.

- How to Interpret Growth Headlines

When you see growth comparisons:

Ask what’s being measured

Consider population effects

Look beyond quarterly data

Compare volatility, not just speed

Understand policy trade-offs

This prevents misleading conclusions.

YouTube Embed (Contextual & Playable)

Embed an explainer such as:

“Why Europe Grows Slower Than the U.S.”

Choose an economics-education channel that focuses on structural differences, not ideology.

- FAQs (Schema-Ready)

Is slower eurozone growth a problem?

Not necessarily—it reflects stability priorities.

Does the euro limit growth?

It limits flexibility, not potential.

Why does the U.S. grow faster?

Demographics, flexibility, and risk tolerance.

Can Europe increase growth without losing stability?

Incrementally, through reforms.

Will growth rates converge?

Unlikely—models differ fundamentally.

Internal link

https://dailyeuros.com/index.php/2026/01/09/eurozone-recession-what-it-means-for-households

External link