Introduction Euro Go Up or Down

What Makes the Euro Go Up or Down? Real Drivers Explained The euro goes up or down based on expectations, capital flows, and relative attractiveness, not because of one headline or a single economic number. Most euro moves are driven by how investors compare the eurozone to other major economies—especially the United States—at any given moment.

This matters because many people misread euro movements. They assume price changes mean something is “wrong” or “right” with Europe. In reality, the euro often moves because markets adjust their view of future interest rates, growth, or risk. Understanding these forces helps you avoid emotional decisions—whether you’re investing, running a business, or simply exchanging money for travel.

FAQs Euro Go Up or Down

Conclusion Euro Go Up or Down

- The Short Answer (Featured-Snippet Ready) Euro Go Up or Down

The euro goes up or down when investors change where they want to hold money, based on interest-rate expectations, risk sentiment, and economic surprises. It’s a relative decision, not a judgment on Europe alone.

- The Relative Nature of Currency Movement Euro Go Up or Down

Currencies don’t move in isolation. The euro is always compared against another currency—most often the U.S. dollar.

This means:

The euro can fall even if Europe is stable.

The euro can rise even when Europe’s data looks weak.

What matters is how Europe compares to alternatives.

Think of EUR/USD as a comparison between two futures. Whichever looks more attractive tends to win.

- Interest Rates: The Strongest Long-Term Driver

Interest-rate expectations shape currency trends more than any other factor.

When markets expect:

higher returns in euro assets → euro tends to strengthen

lower returns relative to others → euro tends to weaken

Importantly, currencies respond to expected future rates, not just current rates.

Why this matters in practice

If markets believe the eurozone will cut rates earlier than the U.S., capital often shifts toward dollar assets—even before any official decision is announced.

[Expert Warning]

The euro often moves before central banks act. Waiting for confirmation usually means reacting late.

- Capital Flows and Investor Behavior

Large investors—funds, institutions, corporations—move enormous amounts of money across borders. These flows matter more than retail trading.

Capital tends to move toward:

higher expected returns,

stronger growth prospects,

perceived safety during uncertainty.

When capital flows favor the dollar, the euro can weaken gradually over weeks. When flows reverse, the euro can recover just as steadily.

- Risk Sentiment: Fear vs Confidence

Global mood plays a major role in euro movement.

During risk-off periods (fear, uncertainty), investors often prefer USD.

During risk-on periods (confidence, growth), demand for euros and other currencies can rise.

This is why euro moves sometimes have little to do with European data. The driver is global sentiment, not local conditions.

[Pro-Tip]

If markets feel nervous, assume USD demand may rise—even without eurozone-specific news.

- Economic Data and the Power of Surprises

Economic data moves the euro only when it changes expectations.

A strong number that was expected does little. A weaker-than-expected number can shift currency trends instantly.

Data that often matters:

inflation reports,

employment figures,

growth indicators,

business confidence surveys.

The euro reacts not to the number—but to how far it deviates from what markets anticipated.

- The Slower Forces: Trade Balance and Energy Costs

Some euro drivers operate quietly in the background.

The eurozone imports large amounts of energy. When energy prices rise:

more euros are exchanged for foreign currencies,

trade balances can deteriorate,

long-term pressure on the euro can build.

These forces don’t cause sharp daily moves. They shape medium-term direction.

[Money-Saving Recommendation]

If you exchange euros regularly, long-term trends matter more than daily fluctuations. Focus on planning, not perfect timing.

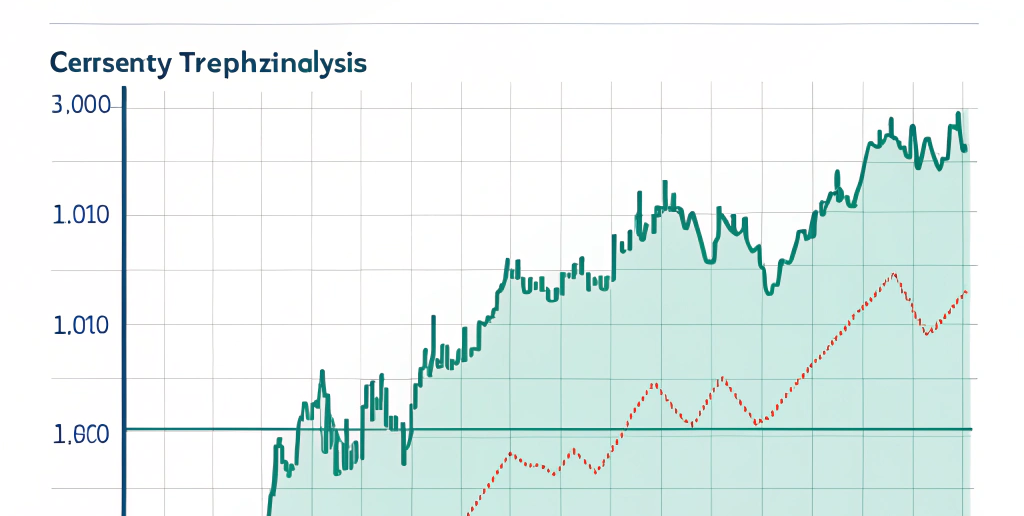

- Information Gain: Why Charts Alone Don’t Explain Euro Moves

Many top-ranking articles rely heavily on charts and indicators. Charts are useful—but incomplete.

What charts show well

past price behavior,

momentum,

volatility.

What charts don’t show

why capital is moving,

how expectations are changing,

whether a move is structural or emotional.

A better approach combines:

fundamentals (rates, growth),

sentiment (risk-on/off),

positioning (who is already invested).

Charts tell you where price moved. Fundamentals explain why.

- Practical Table: What Pushes the Euro Up or Down

| Driver | When Euro Rises | When Euro Falls | Practical Meaning |

| Interest rates | Higher expected euro returns | Lower expected returns | Watch policy signals |

| Capital flows | Money moves into euro assets | Money exits euro assets | Trends persist |

| Risk sentiment | Global confidence improves | Fear dominates markets | USD often wins fear |

| Economic data | Positive surprises | Negative surprises | Expectations matter |

| Trade balance | Export strength | Rising import costs | Slow pressure |

- Common Mistakes and Fixes

Mistake 1: Thinking one factor explains everything

Fix: Look for which driver dominates right now.

Mistake 2: Reacting to every headline

Fix: Ask if the news changes expectations.

Mistake 3: Overusing technical indicators

Fix: Combine charts with fundamentals.

Mistake 4: Assuming reversals are guaranteed

Fix: Trends can last longer than expected.

- UNIQUE SECTION — Beginner Mistake Most People Make Euro Go Up or Down

The most common beginner mistake is assuming the euro “should” behave a certain way.

People expect:

strong data = euro up,

weak data = euro down.

In reality, markets care about relative outcomes and surprises. Once you stop thinking in absolutes, euro movements start to make sense—and decision-making becomes calmer.

YouTube Embed (Contextual & Playable)

For a clear visual explanation, embed an educational video such as:

“What Moves Currency Exchange Rates?”

Choose a channel focused on economics or macro fundamentals, not short-term predictions.

- FAQs (Schema-Ready) Euro Go Up or Down

What is the biggest factor moving the euro?

Interest-rate expectations and capital flows.

Does political news move the euro?

Only if it changes economic or policy expectations.

Why does the euro fall even with good data?

Because the data was already expected—or other factors dominate.

Can sentiment alone move the euro?

Yes, especially during global uncertainty.

Is technical analysis enough to trade EUR/USD?

No. Fundamentals and sentiment matter more.

- Conclusion

The euro goes up or down because money moves toward opportunity and away from uncertainty. Interest rates, capital flows, risk sentiment, and economic surprises drive those movements—not isolated headlines.

internal link

https://dailyeuros.com/index.php/2026/01/07/eur-usd-weekly-outlook-what-actually-matters

external link